Why It is Your Moral Duty to Charge More Money (Part 2)

In Part 1 of this post, I discussed how the feeling of financial insecurity can be mapped to simple math—a person who feels financially insecure does not have much of a cushion. For many people, the best way to increase your cushion is to bring in more money, and the best way to do that is to charge higher prices for whatever you do. Some people will feel an emotional block at the prospect of charging more—guilt, in the case of the protagonists from Part 1. Read Part 1 of this note here.

In Part 2 of this note, I’m going to talk about macroeconomics first, and then talk about the emotional stuff.

Macroeconomics First, Then Emotions

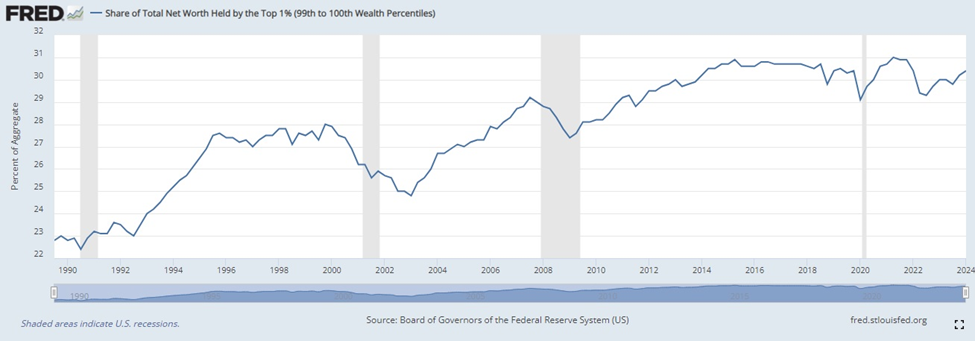

I want to start with a simple chart on wealth inequality:

This chart shows the percentage of total wealth in the United States held by the top 1% wealthiest households. The fact that the share of wealth held by the top 1% has gone up from 23% in 1990 to 30% today isn’t the important part, exactly—it’s more that we all intuitively understand that the wealth distribution (at least in the U.S.) has become more lopsided over the past generation, and this chart is just one of many ways to show that.

My belief is that “wealth becoming increasingly unequally distributed” is an inherent property of capitalist systems. Note that I used the word “property” and didn’t use the words “feature” or “bug.” I’m not making a value judgment on whether unequal distribution of wealth in and of itself is right or wrong. I’m just saying in a free-market system, more and more wealth will accumulate in the hands of a smaller and smaller group of people and that’s just how the system works.

From a behavioral standpoint, I think there are two reasons why this happens:

1) Human beings have a natural tendency to hoard

2) Rich people run out of things to spend money on

The hoarding behavior stems from fears of scarcity and want, in my view. Some of this is natural, and some of it can result from a warped perspective on reality. I’ve felt this at a mild level in a lot of my emotions & finance conversations—when the scarcity mindset dominates, there’s no amount of money in the bank that will make a person feel safe.

In the context of very wealthy people, I think factor #2 is more important. When a person’s net worth increases from $100 million to $200 million, I highly doubt that their spending habits will change materially. A person with exceptional skill in creating value for others (the benign explanation for how a person becomes rich) or exceptional ability to manipulate the system in a nefarious way (the malicious explanation) may find it easy to go from $100 million to $200 million, but there’s nothing to spend that $200 million on, so it will just sit in an investment account.

Some wealthy people ultimately turn to large-scale charitable giving because that’s really the only thing you can do with that much money, but that tends to happen late in life.

The Wealthy Will Pay for Time and Slightly Better Products

What do wealthy people pay for? Two things:

1) Time

2) Slightly better products and services

We have already established that people have very different amounts of money, but everyone has the same amount of time. Everyone will live for 70-80 years or so and everyone has only 24 hours in the day. Rich people are often willing to trade money for time, because time is scarce for them and money is not. This is why they hire drivers, personal chefs, administrative assistants, etc.

Rich people are also willing to pay for slightly better versions of products:

1) A first-class plane ticket and a coach-class ticket are the same basic product, in my view—transportation from point A to point B. Yet a first-class ticket costs 5-10x of what a coach-class ticket costs.

2) A Toyota Camry costs maybe $35,000 today, while a Bentley costs maybe $350,000. In terms of the basic purpose of a vehicle—getting from point A to point B—is a Bentley really 10x better than a Toyota? Does it get you to point B 10x faster or 10x more safely? Of course not. But when you have 1000x the money of an average Toyota customer, you will happily pay 10x for a slightly better car than a Toyota because you have nothing else to spend the money on.

One of my NYC yoga teacher friends cracked the code of how to not starve as a yoga teacher. She said the value chain for teaching yoga looked like this, from least to most lucrative:

Teaching yoga classes at a studio --> running yoga teacher trainings --> yoga retreats --> private yoga sessions to high net-worth individuals

She might have gotten $75/hour to teach a class at a studio but could make $500/hour doing privates. Why? She’s providing a slightly better product (personalized instruction) and saving time for the customer (she’ll travel to the student’s house, rather than the student having to travel to the studio).

Money Gets Frozen At the Top, and It’s Your Duty to Get it Unfrozen

Let’s return to the therapist and yoga teacher from Part 1. They expressed that middle class and poor people would often like to buy services from each other. They would love to get a weekly massage and pay full price, and would be happy to work an extra hour to pay for it, but they can’t find extra customers. That’s why you see a lot of people doing services exchanges—they have a lot of time, but not much money, and they are willing to trade their time to each other. Where has the money that they could be using to buy each other’s services gone?

In my view, that money is frozen at the top. It’s an inherent property of capitalism that the rich get richer. They have nothing to spend the money on, and even if they buy extreme luxury products and services, they still have a ton of money left over. Effectively, the money just sits in the investment accounts of the wealthy, and is basically calcified and locked out from the larger economy. It’s not because rich people are evil or greedy, it’s just how the system works.

The point I made to these two women is that it is their MORAL DUTY to play their part in getting that frozen money unfrozen, and flowing back into the real economy where the middle class and the poor can benefit from it. This is the framing I offered to them:

1) By creating a premium product (e.g. private yoga lessons) you are creating value for your customer (a rich person) and creating value for others (serving others) inherently feels good;

2) By getting more money into your own bank account, you are developing the strength to serve others more in the future (putting your own oxygen mask on first);

3) You will use some of the money to buy goods and services from other middle-class and poor people, giving them a chance to earn, create some financial breathing space for themselves, and keep that money flowing in the economy. Under capitalism, this is morally good! And if you live in a capitalist society, you might as well play the game in a way that feels good to you.

Both women had one objection to this framing, and that was “what about the people I am pricing out of my services, what about the people I’m leaving behind”. My response—when you get to a place of feeling more financially secure, give your stuff away for free! Nothing is stopping you from doing a public free yoga class or offering free therapy to vulnerable populations through a nonprofit, except for your own lack of financial stability.

Once you get yours, give!

Exercise

Journal on the following or discuss with a friend.

1) Noticing

When you consider the prospect of “robbing from selling to the rich, giving to buying from the poor,” what emotion comes up for you?

You may notice anger—“it shouldn’t be this way,” “the system feels unfair,” etc. That’s fine. Accept that feeling also. Just remember that most people feel pride in working to earn rewards, and often feel shame at depending on the charity of others. When you give someone a chance to earn, what emotional gift are you giving to them?

2) Brainstorming

Consider your existing suite of products, services, side gigs, etc. that you offer to earn money. Brainstorm some premium versions of what you currently offer that would be worth more value to your customer.

If you are a salaried employee and feel that you are not fully utilized, brainstorm areas where you could ask for greater responsibility in exchange for higher salary.

3) Action

Pick one premium product or service you brainstormed and pitch it to one person at a higher price than what you normally charge. It doesn’t matter if they say yes or no.

If it feels scary, good. If the exercise wasn’t scary, it would be useless. I am not here to waste your time.