Fedwatching: Looking Ahead to the 28-29 Jan 2025 FOMC Meeting

We are now in the FOMC quiet period (no Fed communication two Saturdays before the next meeting) so I wanted to put together a note to take stock of where the Committee stands. Full disclosure—I was wrong the last time I tried to predict what the Fed would do. (But I haven’t been wrong about rates going up…)

· The Fed cutting cycle seems to be over as quickly as it started. After cutting rates by 50 basis points at the September 2024 meeting, and a further 50 bps over the rest of the year, market prices now imply only one further cut, in June or later of this year.

· Market prices imply no change to rates at the January meeting. Obviously everyone is waiting to see exactly what the new administration does on tariffs (inflationary), taxes (inflationary), immigration (inflationary) and deregulation (disinflationary).

· I think there’s a bigger chance we get rate hikes this year than more than one cut. Most of Trump’s policy proposals look inflationary and many FOMC voters are betting on housing inflation to come down. Housing starts of 1.48m (saar) in December are above the long-run average of 1.43m since 1960, but the U.S. is also a bigger country than it was in 1960.

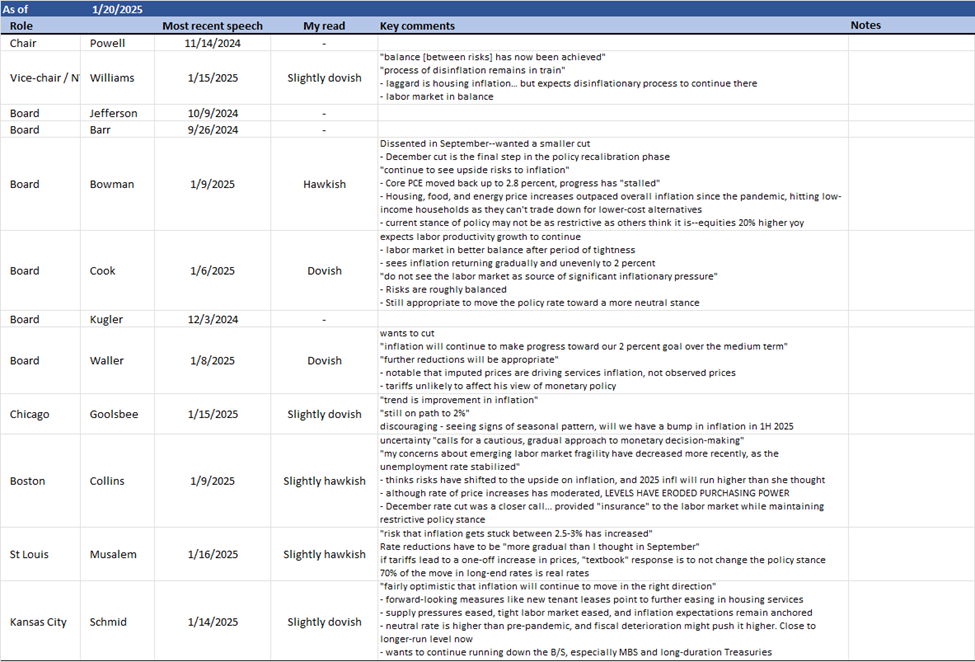

FOMC Matrix – 20 Jan 2025

Some of the things that stood out to me from the last three weeks of Fedspeak:

· The Boston Fed’s Collins is the only FOMC official talking about the impact of cumulative price increases up until this point on real purchasing power. Although deflating hourly and weekly earnings by PCE/CPI shows that real wages have increased since the pandemic, the breakdown by sector shows some declines.

· There’s a spirited debate among FOMC officials about housing services inflation and whether or not the imputed portion of PCE is accurate or not. Judging from vibes, people don’t feel like housing is affordable.

· The median committee member is slightly dovish by my read and is saying something like “I am optimistic that inflation will make progress towards 2% over the medium term” and typically cites lower rates of housing services inflation as old leases roll over into new ones.

· Waller wants to cut, and thinks tariffs won’t be inflationary. If I wanted to be the next Fed chair, these are exactly the things I’d by trying to say within earshot of Donald Trump.

· Bowman and St. Louis’ Musalem sound the most hawkish. Bowman was explicit that she thinks the cutting cycle should be over and Musalem is concerned that inflation gets stuck in the 2.5-3% range.

· Schmid called out the risk of fiscal deterioration pushing long-end rates higher, and reiterated a point from an earlier speech asserting that the neutral rate is higher than it was pre-pandemic.