So how about that rate cut?

TL;DR – I don’t expect the Fed will make any change to interest rates before the election.

I’ve been saying for a while that people baking in three rate cuts this year are engaged in wishful thinking, and that the risk that we won’t get even one rate cut is underappreciated. After the employment and inflation data of the last two weeks, followed by comments from FOMC voters, the market is finally starting to wake up to the possibility that we may not get any cuts at all and “high” interest rates are here to stay for the foreseeable future (interest rates are not “high,” btw. People have just forgotten what a normal interest rate regime looks like.)

In this post I recap the recent data and Fed comments, and conclude with a thought on the most underappreciated risk going forward.

Where did the data come out?

As a refresher, the Fed, by law, focuses on full employment and price stability. The two most important sets of economic data are those relating to unemployment and job creation, and those relating to inflation.

The March Employment Situation Report revealed that the U.S. unemployment rate was unchanged at 3.8% (well-below the long-run average of just under 6%). Total payrolls rose 303,000 in March, with above-trend growth in healthcare, construction and government. The market was expecting ~200,000. The Fed cuts rates to stimulate the economy when the job market is weak—this report isn’t indicative of a weak job market.

The February Personal Consumption Expenditures Price Index (the Fed’s official gauge of inflation) came in at 2.5% annualized, while the March Consumer Price Index showed a 3.5% increase year-over-year. Given that both figures went up relative to last month’s readings, they don’t meet Powell’s stated rate-cut criterion “that inflation is moving sustainably down toward 2 percent.”

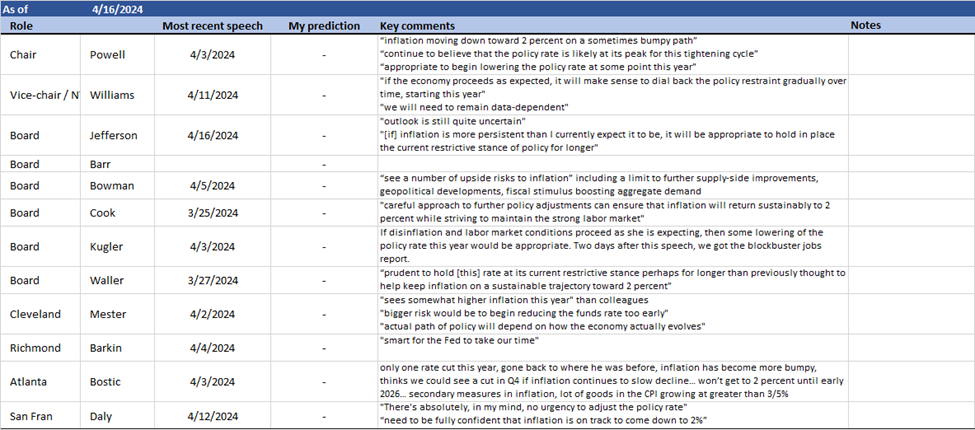

What did Fed speakers say?

The strong jobs data and higher-than-expected inflation data has clearly made Fed voters more reluctant to cut rates:

The Fed won’t be cutting soon

My guess is that they need to see inflation coming down over at least 3 consecutive months before they seriously consider a rate cut, which would put us in mid-July… and then the election is barely three months away. When the Fed says that they don’t consider political factors in making decisions about monetary policy, I believe them, but I also don’t think that they will make any change to interest rates shortly before the election unless the case for it is almost unassailable. Not that making a small adjustment to interest rates would have a significant economic impact within 3 months anyway.

Market pricing suggests 1.5 rate cuts over the next year, only a 50% chance of a rate cut in the next 6 months. That’s down from a full 3 rate cuts being priced in over the coming year at the beginning of January. Some economists have started suggesting that the Fed’s next move will be a hike—certainly possible, but that hasn’t shown up in any Fed speaker’s comments yet.

What would it take to cut rates? A significant deterioration in the economy, which I see coming from CRE and private equity bankruptcies over the next 2-3 years. There’s a lot of talk of the impact of CRE defaults on regional bank balance sheets, but private equity is just as sensitive to higher interest rates and there are going to be a lot of companies that can’t handle higher interest expense burdens after refinancing. We haven’t seen many high-profile stories of PE-backed firms going bust, but I still think they’re coming.