Understanding Business Write-Offs for Solopreneurs

Several people have recently mentioned to me that they don't have a good understanding of how "writing off" or "expensing" something to your business works, so I decided to put together a guide.

This note is intended for people who are residents of the United States. The basic logic applies to most other countries, but specific tax rules vary from jurisdiction to jurisdiction.

***Note: I am a finance professor, not a tax accountant. The following is intended as general financial education, not as discrete tax advice for your specific situation.***

TL;DR

1) Tax write-offs[1], or expenses, are costs related to operating a business that are formally allocated to the business.

2) Business income tax is levied on profit, not on revenue.

3) Revenue – Expenses = Profit

4) By assigning legitimate expenses to a business, its profit is lowered and in turn the business’s tax liability is lowered, leaving the entrepreneur with more money in their pocket at the end of the day.

Contents:

I. Primer on Revenues, Expenses, Taxes and Profit

II. Notable Business Expenses for Solopreneurs and Side Gigs

III. Example: Sarah the Massage Therapist

I. Primer on Revenues, Expenses, Taxes and Profit

What are Business Expenses?

You have to spend money to make money.

This adage is literally true in the world of business accounting. No matter what type of business you have, you will almost certainly have some expenses necessary to run the business.

If you operate a yoga studio, your expenses include teacher salaries, rent, utility bills, possibly marketing, social media and web hosting, booking software, decorations for the studio, tea and teacups, and so on. If you operate a resume coaching business as a side gig, your paid Zoom account would be a business expense (since you shouldn’t use your day job employer’s Zoom account for your personal business).

People sometimes refer to a business expense as a “write-off.” It’s just business slang.

How Expenses Relate to Revenue and Profit

Revenue – Expenses = Profit

Revenue is the total dollar value of all sales you make.

Let’s say you operate a hot dog stand. You sell each hot dog for $3. Yesterday, you sold 50 hot dogs. Your revenue for yesterday was $3 x 50 = $150.

However, that’s not your profit. In order to calculate how much profit you made, you have to take into account the cost of the ingredients.

Let’s say each hot dog costs $2.50 in ingredients--$1 for the sausage, $1 for the bun, $.25 for the wrapper, and $.25 for the condiments.

You sell each hot dog for $3, it takes $2.50 in ingredients to make, so your profit is $.50 per hot dog. If you sold 50 hot dogs, then your profit for the day is 50 x $.50 = $25.

Broadly speaking, expenses are anything that a business has to spend money on in order to make money. In the hot dog stand example, the ingredients are something the business has to spend money on in order to make money—you can’t sell a hot dog without making it from ingredients first. Your costs[2] are $2.50 per hot dog, times 50 hot dogs, or $125.

$150 revenue - $125 costs or expenses = $25 profit

Businesses are Taxed on their Profit

Businesses pay income taxes on their profit, NOT their revenue.

Let’s say your business tax rate is 20%. If you were taxed on your revenue of $150, then you would owe $150 x 20% = $30 in taxes. But you only profited $25, so owing $30 in taxes makes no sense.

In actuality, you owe taxes on your profit of $25. $25 x 20% = $5 in taxes owed.

Why Accounting for Business Expenses Matters

Properly accounting for legitimate business expenses lowers the business’s tax liability, resulting in more take-home income after taxes for the owner.

Why is this the case?

Most businesses cost at least some money to run. You can pay those costs (expenses) out of pre-tax or post-tax income.

Let’s say you own a woodworking business as a side gig. You make $10,000 in revenue per year for that business. Raw materials cost $3,000 and you also spend $1,000 on Internet marketing.

If you fail to allocate your $1,000 in marketing expenses to the business, your financials look like this: $10,000 revenue - $3,000 cost of goods sold = $7,000 in pre-tax income. Then apply a 20% tax rate ($1,400) and you’re left with $7,000 pre-tax income - $1,400 taxes = $5,600 in take-home profit. Then you spend $1,000 on marketing, and you’re actually only left over with $4,600.

That $1,000 should be a business expense, and come out before taxes. If properly accounting for all legitimate businesses expenses, your woodworking side gig should look like this:

$10,000 revenue - $3,000 cost of goods sold - $1,000 marketing expenses = $6,000 in pre-tax profit - $1,200 tax liability = $4,800 in take-home profit.

By “writing off” your marketing expenses as a business expense, you ended up with $200 more at the end!

This ability to write off portions of certain day-to-day expenses that all people have to a business—like having a car or house, regular phone and Internet bills, and so on—can save an entrepreneur a significant amount of money in taxes at the end of the year. This is because if you operate a legitimate business, it’s likely that some of these “personal” expenses are actually being used for business purposes. You have to pay for your home and phone anyway, so why not assign a portion of that spending to your business if you do actually use them in your business, where it helps to reduce your taxes?

The following section goes through the most common business expenses for solo entrepreneurs.

II. Notable Business Expenses for Solopreneurs and Side Gigs

A. Portion of Home used Exclusively for Business Purposes

A portion of routine expenses associated with owning a home can be deducted as business expenses. These include real estate taxes, mortgage interest, rent, utilities, insurance, depreciation, maintenance, and repairs.[3]

The portion you can allocate to the business is the percentage of the home’s square footage used exclusively for your business, either to meet with customers, as a standalone structure, or as your principal place of business. For example, if you own a 1500 square foot home and you have a 300 square foot room that you use exclusively as a business office, you can assign 300/1500 = 20% of your real estate taxes, mortgage interest, utilities of the home (including water, electricity, gas, and trash), homeowner’s insurance, and home maintenance expense to the business.

B. Rent

If you rent space needed to operate your business, that is deductible.

For example, if you are a hair stylist and you rent a small salon to perform your work, that rent is a deductible business expense.

C. Educational Expenses

If you are a self-employed individual, you can deduct certain educational costs as a business expense.

In order to qualify, the education has to be something that (1) maintains or improves skills needed in your present work or (2) something that the law requires you to keep your current occupational status. Education needed to enter a new trade or business doesn’t qualify.[4]

For example, if you’re already a lawyer, the cost of Continuing Legal Education (CLE) can be expensed to your law practice. If you aren’t already a lawyer, the cost of going to law school cannot be expensed.

You can deduct tuition, books, and so on, as well as transportation costs related to obtaining the education.

The IRS has a simple questionnaire to help you decide if your educational expenses are deductible.

D. Advertising and Marketing Expenses

Expenses related to bringing in new customers and keeping existing ones are deductible.[5]

For example, hiring a social media marketing firm to promote your business, or buying ads on Google, Facebook, or a local newspaper, should both be deductible. Providing food or entertainment to the public as a form of advertising is also deductible—for example, if you operate a coffee roastery and you give away free drinks to the public at a local county fair, the costs of providing those drinks should be deductible.

E. Internet Hosting and Software Expenses

Software subscriptions and various Internet hosting fees should all be deductible if they are used exclusively for business.

For example, if you are an independent headhunter or a resume consultant, a subscription to LinkedIn Premium is probably deductible for you. If you operate a yoga studio or hair salon, subscriptions to scheduling/booking software like MindBody Online and Vagaro are deductible. If you are a photographer, software like Adobe Photoshop should be deductible. If you are a management consultant like me, your subscriptions to Microsoft Office 365, Zoom, and Google Workspaces are all deductible.

Online hosting services are also deductible. I deduct the costs of website hosting at Ghost, Carrd, and Wordpress as business expenses.

My Spotify subscription is not deductible, since I don’t use it exclusively for business.

F. Phone and Internet expenses

If you are a solopreneur, a portion of your phone and Internet service costs can usually be assigned to your business. Unless you are keeping minute-to-minute records of how much time you spend on your computer working versus general surfing or other entertainment (far too tedious for most people), you will need to use some judgment in allocating the costs to your business.

I assign 50% of my phone and internet bill to my business as an expense, since that’s my rough estimate of how much time I spend using these services for work as opposed to personal reasons. If your guess is that you spend 30% of your online time on your business, then you should assign only 30% of the annual bill to your business. If you try to assign 100% of your personal phone and home internet bills to your business, that is likely to raise red flags at the IRS.

G. Meals, Entertainment and Travel

1. Meals

From 2023 and onwards, you can generally deduct 50% of the cost of business meals if you or an employee are physically present and the meal is provided to a customer or other business contact.[6] The meal can’t be “lavish or extravagant.”[7]

Example: I meet Michelle, a fellow independent consultant on a project I am working on, for lunch at a restaurant. We discuss the client project during the meal. I pick up the tab of $60. I can deduct half ($30) as a business expense on my tax return.

I keep track of my business meals in an Excel spreadsheet as I have them—I record who I met with, the date, and a short description of what it was about. I also toss the physical receipt into a folder with all of my other relevant tax documents for the year. The IRS doesn’t require this information, but if I get audited, I can send them the spreadsheet and a picture of all of the receipts.

2. Entertainment

Entertainment is generally not deductible as a business expense. However, there are exceptions, but most will not be relevant to solopreneurs. If there is an activity that in your course of work would be considered ordinary and necessary, but considered entertainment in other industries, it may be deductible.

The IRS gives the example of a nightclub operator—expenses related to running a nightclub (hiring a DJ, for example) would be a deductible expense since you are in the entertainment business. Taking a client to a nightclub if you are not in the entertainment business would not be deductible. If you treat your client to a meal at the nightclub (do nightclubs sell food?), and you are discussing business in da club, 50% of the food cost can be treated as a business expense.

3. Travel

Travel expenses for work are generally deductible[8], including the cost of hotels and meals. In order for a trip to count as “work travel,” you have to be away from your home long enough to require rest. Spending a night clearly counts. A day trip might count if you spend a significant amount of time resting during the day (the IRS gives an example of a train operator spending 6 hours at a hotel in the middle of the day).

Things you can expense:

- Transportation costs (plane, bus or train tickets, taxis, subway fares, etc.)

- Food and lodging if your trip is overnight or requires a long period of rest

- Food is 50% deductible if you’re on a business trip and it’s not an entertainment meal.

- Alternately, you can deduct a daily amount for food. The exact amount depends on where you’re traveling. In 2022, you could deduct $59 per day towards meals for most of the U.S.

- Tips related to the above

- Car expenses and car rentals

- Laundry expenses

Things get tricky when you mix work and personal travel. In general, you have to divide up your expenses between personal and work expenses. If your trip is primarily for personal reasons, you can’t expense any part of the travel and can only expense direct business-related expenses. If your trip is primarily for business, you have to take out the personal portion.

For example, if you have a 9-day business trip, but spend 3 days visiting your family, you can only treat 6 days worth of expenses as a business trip. The IRS has a detailed example here.

The rules are more complicated when you are traveling outside of the U.S., but generally speaking, are more generous when mixing work and personal travel. They’re too situational to distill in this document, but you can find the details here.

If family members are traveling with you, you can’t deduct their travel expenses unless they are present for business reasons.

H. Car expenses

The principles of assigning car expenses to your business are similar to business travel. If you own a car that you split between business use (e.g., you are a sound healer and you have to drive to deliver trainings in another state) and personal use, you assign the expenses based on the ratio of business to personal use.

For example, if you drive your car 20,000 miles in a year, and 12,000 of those miles were for business purposes, you can assign (12,000/20,000) 60% of your car expenses for the year to your business. Eligible expenses include gas, oil changes, tolls, lease payments, car insurance, parking costs, general repairs, tires and so on.

Alternatively, you can simply take a standard mileage deduction rate. This rate was 62.5 cents per mile in late 2022. In the above example, if you drove 12,000 miles for business in a year, you would be eligible to deduct (12,000*.625) $7,500 in expenses from your business income.

Regardless of which approach I choose, I would keep records of my business travel. For example, if I drive to Houston for a business meeting, I would keep track of the number of miles driven, the date, and who I met with. I would also keep a record of how many miles were on my odometer on January 1 and on December 31, so I know the total miles driven in the year. This is tedious, but could save me a lot of money in taxes if I drive a lot in my personal business.

I. Accounting and legal expenses

Accounting and legal expenses relating to operating a business can usually be deducted as business expenses. An example would be hiring a lawyer to negotiate a contract with a customer.

Legal fees related to acquiring a piece of property are added in to the tax basis of the property (i.e., you get to add legal fees in to the cost at which you bought the property. This reduces future tax liability when you sell the property.)

J. Tax preparation fees

Self-employed taxpayers can count tax preparation fees (e.g. TurboTax or hiring an accountant) as business expenses.

K. Licenses and regulatory fees

Licenses and regulatory fees related to your trade or business can be deducted as business expenses. If I had a law practice, my biannual $375 fees to the New York Bar could be deducted as expenses for my law practice.

Since I don’t practice law within my management consulting business, I can’t treat the $375 fee as a business expense for my management consulting business.

L. Professional Association membership fees and dues

Memberships in professional associations, if relevant to your business, can be deducted as a business expense. My annual dues to the CFA Institute to keep my Chartered Financial Analyst designation current are deductible from my management consulting business, since I do a lot of finance work there.

III. Example: Sarah the Massage Therapist

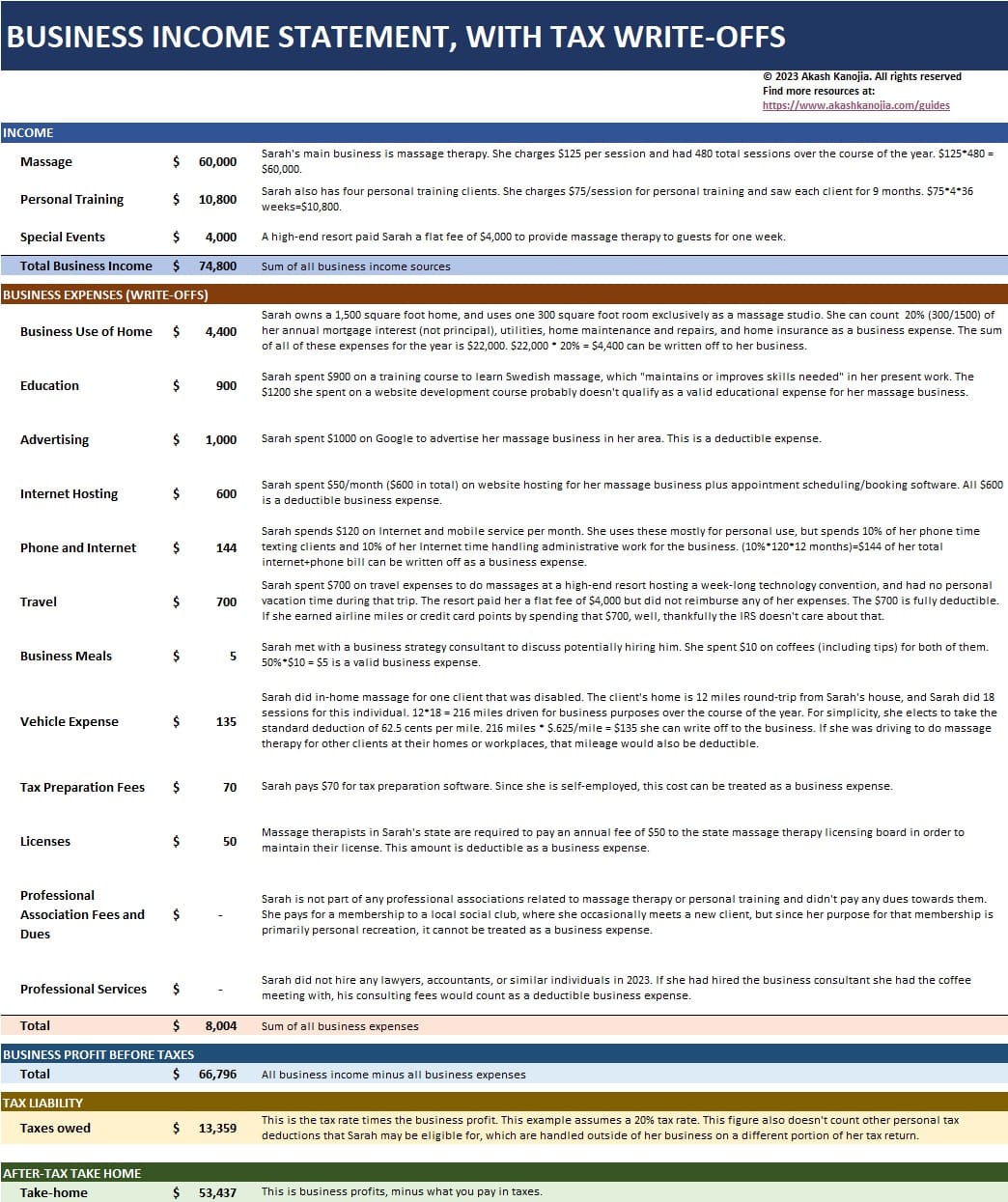

Let’s look at an example. Sarah is a solopreneur who does massage therapy and physical training as part of her physical wellness business. Her income statement below shows her sources of business revenue, business expenses, and her tax liability and after-tax take-home income.

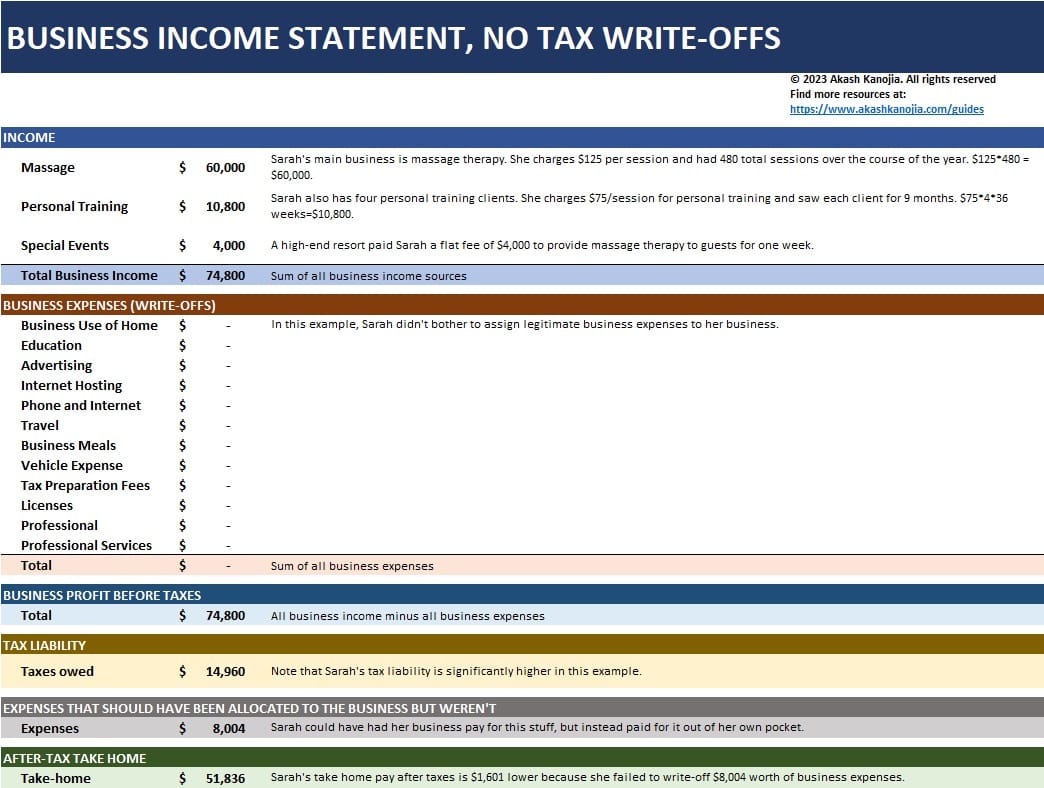

Now let’s compare that to the same business, except Sarah doesn’t write off any legitimate business expenses to her business. Instead, she pays for them out of her own pocket, and isn’t able to use them to reduce her business tax liability.

As you can see, by accurately assigning her legitimate business expenses to her business, Sarah reduces her business income tax liability for the year by $1,601 and as a result has $1,601 more left in her pocket at the end of the year.

If you are a solopreneur, or a W-2 employee with a side gig that makes some money, make sure you assign whatever legitimate expenses you can to your business! More details are available at the Internal Revenue Service's website at the links in the footnotes.

[1] The phrase “write-off” is also sometimes used to describe a loss on the value of an asset. We aren’t talking about that kind of write-off here.

[2] In technical accounting language, the ingredients of a hot dog are recorded as “cost of goods sold,” a different category from general “expenses.” In practice they have the same effect in terms of calculating profit.

[3] https://www.irs.gov/taxtopics/tc509

[4] https://www.irs.gov/taxtopics/tc513

[5] https://www.irs.gov/newsroom/small-business-advertising-and-marketing-costs-may-be-tax-deductible

[6] https://www.irs.gov/publications/p463

[7] The definition of “lavish or extravagant” isn’t clear. Taking a customer to a nice restaurant isn’t necessarily extravagant.

[8] https://www.irs.gov/faqs/small-business-self-employed-other-business/income-expenses/income-expenses-2