The Stock Market is Overvalued: A Bond Market Perspective

U.S. stock markets are overvalued, with a duration of 75 at current levels. The refinancing cliff hasn't hit yet, which is likely to pressure earnings.

With the U.S. stock market reaching all-time highs, investors like John Hussman and Jeremy Grantham have reiterated their warnings about valuations and bubbles. I agree with these viewpoints, and want to make two arguments about market valuation that I haven’t seen elsewhere. One pertains to viewing stock market valuations through a bond market framework, and the other pertains to how higher interest rates will flow through the income statement of a corporate and impact bottom-line earnings. (The second one is obvious, but I just want to show the math.)

A Bond Market Perspective on Stocks

As a former bond trader and bond PM, I tend to use fixed-income frameworks to interpret things in other areas of finance. In this case, I’m looking at the stock market through the lens of duration, a key bond market metric.

“Duration”[1] in bond market jargon doesn’t really refer to a length of time (although it’s a closely related concept), but rather the price sensitivity of a bond with respect to a change in interest rates. Said in calculus terms, it is the first derivative of the price-to-yield function with respect to a change in yield. When interest rates go up, bond prices go down, and the duration of the bond predicts how much the price will go down. For example, if the duration of a $100 bond is 9, that means that the price of the bond will fall by 9% (or down to $91) if interest rates go up by one percentage point.

The relationship between prices and interest rates is an inverse one, meaning that rates and prices move in opposite directions. To understand the intuition, consider this example: you buy a bond for $100 that pays 5% interest. The following day, interest rates go up to 6% and you can now buy a 6% paying bond for $100. Are you happy or sad that you bought a bond that pays only 5% the day before? You are sad. And if you want to sell your bond that pays 5% back to the market, will you get $100 for it? You won’t, because anyone that wants to spend $100 to buy a bond can get a 6% one. Your dirty, unattractive 5% bond is no longer worth $100. If you want to get someone to buy it in a market where 6% bonds are available, you have to give them a discount. That discount is the duration.

I have seen commentary over the years that the historical duration of the stock market is in the 20-30 range. This makes intuitive sense to me, as the duration of a 30-year Treasury bond is usually in the 10-15 range, and I expect the average stock to produce cash flows for more than 30 years.

However, we can also calculate the duration of the stock market with precision. The best discussion on the subject I’ve found is from the aforementioned John Hussman. Hussman says the duration of the stock market is simply the inverse of the dividend yield, which is price / dividend yield. He says that as of 2004, the long-term average duration of the stock market was 25. Today, with a dividend yield of 1.32% on the S&P 500, the duration of the stock market is ~75.

That is a crazy number.

A duration of 75 means that if the expected yield on the total stock market increases by one percentage point, the price of the total stock market would fall by 75%. Now, I wouldn’t expect that drastic of a change in price from a one percentage point change in expected return due to a second property of fixed-income cash flows, which is convexity.

Convexity is the rate of change of the duration, or in calculus terms, it is the second derivative of the price-to-yield function with respect to a change in yields. Intuitively, I think of the convexity as the “slippage” in the duration, meaning that if a security has a convexity of any number other than zero, it means the duration will not predict the price change of a security with perfect accuracy. For bonds with positive convexity, it means the price change will never be as “bad” as the duration predicts, from the perspective of the owner of the bond.

I suspect that stocks have very strong positive convexity, meaning that the price impact of a 1% change in expected return will be significantly less than 75%. But there should be a significant decrease in price.

Why Haven’t Stock Prices Already Fallen as Interest Rates Have Risen?

Short answer: I think it has to do with sentiment. (Sentiment is not something that I understand well, but I hope to understand better in the coming years.)

I’ve written before about how I expect asset prices in general to fall due to the recent increases in interest rates, but the response of the nearly-purely-mathematical bond market is always going to be faster than other markets. Moreover, from an equity duration perspective, stock prices should respond to changes in the expected return on stocks, not changes (directly) in the general interest rate environment. If interest rates have gone up, but expectations for stock market returns above the risk-free rate (the equity risk premium) have remained the same, then it could make sense that stock prices don’t change.

From a discounted cash flow perspective, however, it is very clear that stock prices should decline as interest rates rise. That it hasn’t happened yet is very strange to me.

I do think it will happen.

Leaving Multiples Aside, Earnings Should Fall as Well

Duration is just another way of talking about multiples, in this case the multiple of price to dividends. But I think earnings (and by extension, dividends) will fall as well due to the increase in interest rates. This is due to increases in interest payments, a subject which I have touched on before and is starting to get much more attention in the context of government finances.

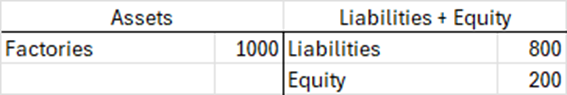

Let’s consider the following stylized balance sheet of a company (loosely based on the actuals from John Deere & Co.):

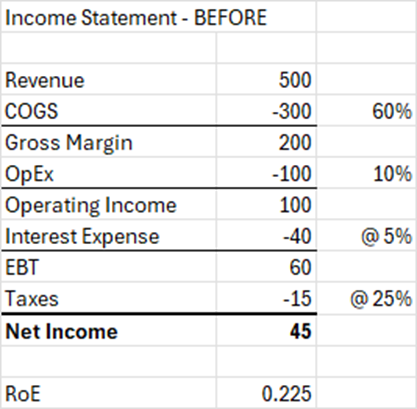

Let’s say the debt carries a 5% interest rate:

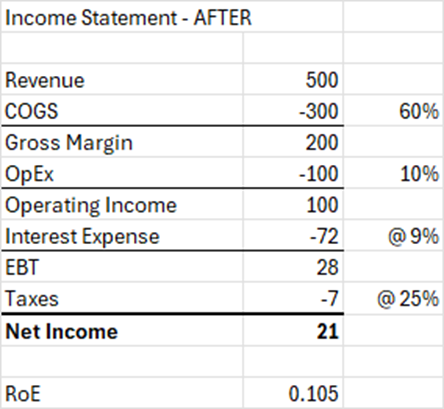

What happens when the existing 80% leverage on the balance sheet gets refinanced 400 bps higher?

This is why it isn’t just multiples that are in danger, but earnings and dividends themselves. In this example, which is loosely based on a real company (I just made the numbers rounder), you can see that earnings that can be distributed to shareholders fall by 50% due to a 400 bps increase in interest rates. There are companies skirting closer to the event horizon who will be forced into bankruptcy if they are forced to refinance at 400 bps higher.

Obviously, if earnings fall by 50%, stock prices would have to fall 50% to maintain the same earnings yield. If earnings fall and multiples return towards historical norms, well, that’s how you get a gigantic collapse in the market of the kind that Hussman talks about.

Looming Bankruptcies

I stand by the point I made two years ago about pent-up bankruptcies in the system. The way that these bankruptcies manifest is through the refinancing/interest expense earnings erosion I describe above. In the above example, we have a company with healthy earnings of 45 that are cut down to 21. But there are also companies that are highly levered and already have shaky earnings. Those are the firms that will be pushed over the brink when they hit the refinancing cliff.

I don’t know what the catalyst for this market decline will be, but I still strongly feel that it’s coming.

[1] For the fixed-income people: I’m referring to modified duration here.